Using Our Knowledge To Help Others

American West Insurance Agency starts with quality, taking to heart the needs of the customer first. American West Insurance Agency has built it’s reputation on being there for it’s customers. That reputation continues today, and will carry on far into the future. Our customers know that excellence is in the very foundation of the business. We can provide insurance quotes for all personal and commercial insurance.

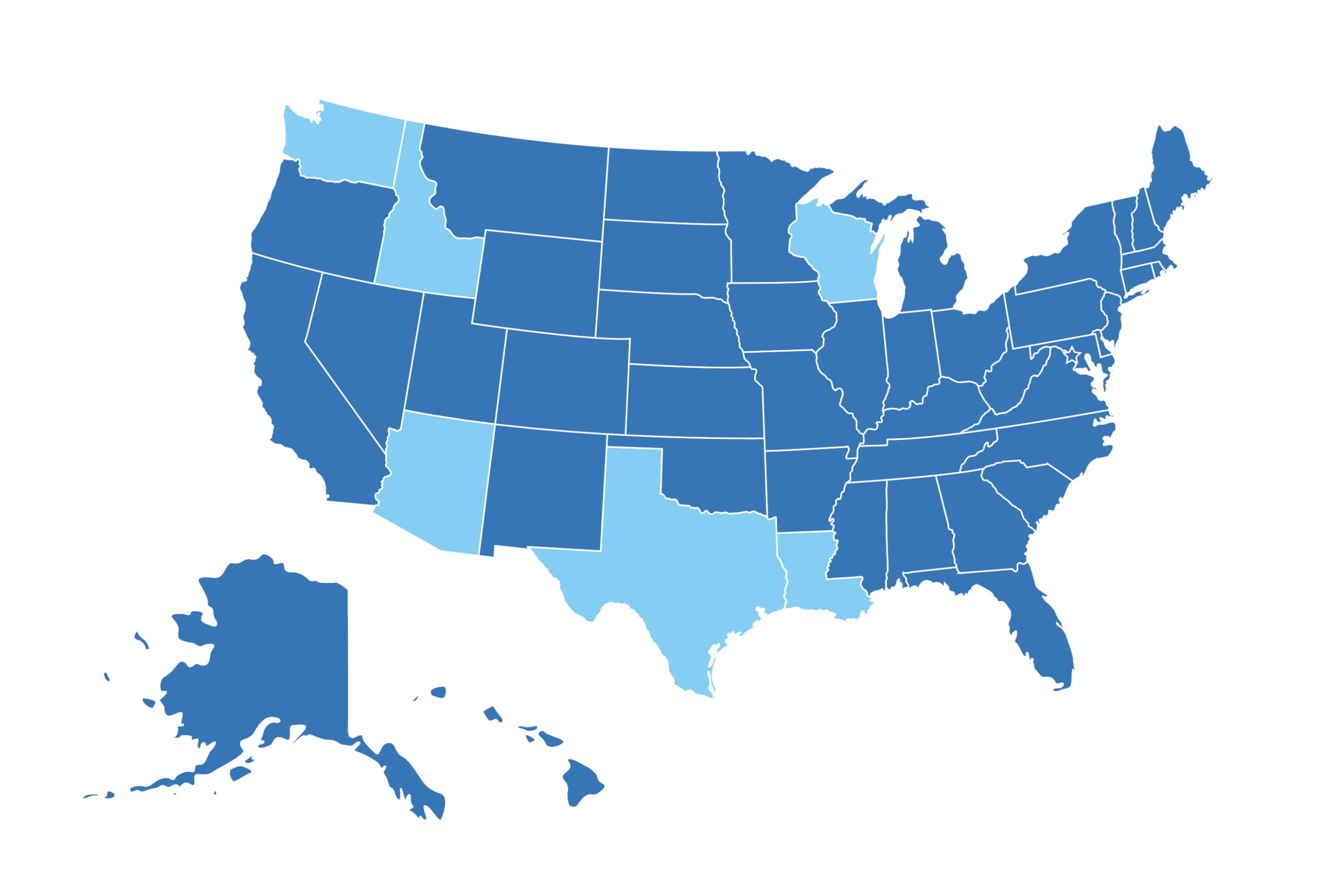

With 30+ years of combined insurance experience, we are now licensed to assist you in Louisiana, Texas, Wisconsin, Washington, Idaho and Arizona.